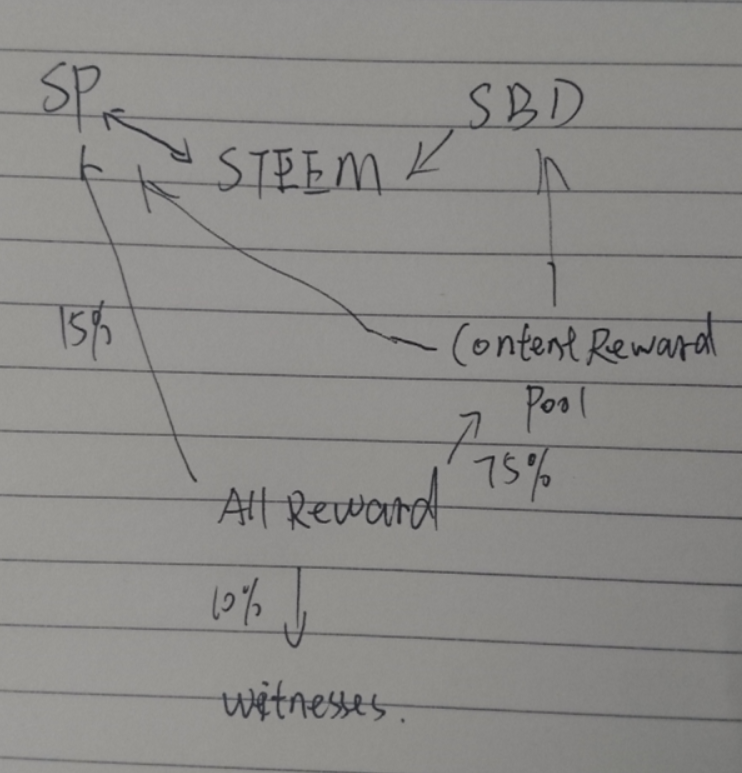

针对最近SBD严重便宜1美元的近况,我一直不太理解,为了理解这个事情,我今天找来steem的白皮书,寻找一些章节试图去理解这个事情,我觉得原来的版本容易看懂,我按照自己理解翻译成中文。

针对最近SBD严重便宜1美元的近况,我一直不太理解,为了理解这个事情,我今天找来steem的白皮书,寻找一些章节试图去理解这个事情,我觉得原来的版本容易看懂,我按照自己理解翻译成中文。

Sustainable Debt to Ownership Ratios

If a token is viewed as ownership in the whole supply of tokens, then a token-convertible-dollar can be viewed as debt. If the debt to ownership ratio gets too high the entire currency can become unstable. Debt conversions can dramatically increase the token supply, which in turn is sold on the market suppressing the price. Subsequent conversions require the issuance of even more tokens. Left unchecked the system can collapse leaving worthless ownership backing a mountain of debt. The higher the debt to ownership ratio becomes the less willing new investors are to bring capital to the table.

A rapid change in the value of STEEM can dramatically change the debt-to-ownership ratio. The blockchain prevents the debt-to-ownership ratio from getting too high, by reducing the amount of STEEM awarded through SBD conversions if the debt level were to exceed 10%. If the amount of SBD debt ever exceeds 10% of the total STEEM market cap, the blockchain will automatically reduce the amount of STEEM generated through conversions to a maximum of 10% of the market cap. This ensures that the blockchain will never have higher than a 10% debt-to-ownership ratio.

The percentage floors used to compute STEEM creation are based on the supply including the STEEM value of all outstanding SBD and SP (as determined by the current rate / feed).

稳定的债务和所有权关系

如果代币被看做steem区块链的所有权,那么可转换成代币的美元就能被看做是债务。如果债务和所有权比例太高,那么整个货币系统就会变得很不稳定。人们大量把债务转换成代币,这会突然大量增加代币的供给,这会导致市场卖家压制了steem的价格。接下来有人要转换SBD,就需要发行新的steem。这样整个系统会坍塌,剩下一堆分文不值的所有权,支撑一堆债务。债务和所有权比例越高,就越不会有新的投资者肯把钱投进来。

steem价格的突然变化,会大大改变债务-所有权比例。区块链系统怎么防止这个比例变得太大呢?如果债务比例超过10%,它就通过减少每个SBD可转换成steem的数量。如果所有SBD的市值超过了所有steem市值的10%,那么系统就会自动地减少生成的steem数量,最大可以达到市值的10%。这样来确保系统的债务不会超过所有权的10%。 计算产生steem的百分比是基于所有未转化的SBD和SP的。

The primary concern of Steem feed producers is to maintain a stable one-to-one conversion between SBD and the U.S. Dollar (USD). Any time SBD is consistently trading above $1.00 USD interest payments must be stopped. In a market where 0% interest on debt still demands a premium, it is safe to say the market is willing to extend more credit than the debt the community is willing to take on. If this happens a SBD will be valued at more than $1.00 and there is little the community can do without charging negative interest rates.

If the debt-to-ownership ratio is low and SBD is trading for less than $1.00, then the interest rate should be increased. This will encourage more people to hold their SBD and support the price.

If SBD trades for less than $1.00 USD and the debt-to-ownership ratio is high, then the feeds should be adjusted upward give more STEEM per SBD. This will increase demand for SBD while also reducing the debt-to-ownership ratio and returning SBD to parity with USD.

Assuming the value of STEEM is growing faster than Steem is creating new SBD, the debt-to-ownership ratio should remain under the target ratio and the interest offered benefits everyone. If the value of the network is flat or falling, then any interest offered will only make the debt-to-ownership ratio worse.

If the debt-to-ownership ratio gets dangerously high and market participants choose to avoid conversion requests, then the feed should be adjusted to increase the rate at which STEEM paid for converting SBD. Changes to the interest rate policy and/or any premiums/discounts on the STEEM/SBD conversion rate should be a slow and measured response to long-term average deviations rather than attempting to respond to short-term market conditions.

It is our belief that these rules will give market participants confidence that they are unlikely lose money by holding SBD purchased at a price of $1.00. We fully expect there to be a narrow trading range between $0.95 and $1.05 for SBD under normal market conditions.

steem旷工最主要关心的是把SBD稳定地锚定在1:1美元关系上。任何时候如果SBD价格比1美元大,就停止支付利息。在市场里,0%的利息还不能阻止人们对SBD需求的话,那就说明市场愿意接受更多的steem。如果这种情况发生,SBD价格就比1美元大,那么社区基本什么也做不了,除了向SBD持有人索取利息。

如果债务和所有权比例很低,而且SBD价格小于1美元,那么系统应该增加支付给SBD持有人的利息。这会鼓励更多人持有SBD来支持它的价格。

如果债务和所有权比例很高,而且SBD价格小于1美元,那么旷工需要调整让SBD可以换取更多的steem。这将会增加SBD的需求,这会减少比例,而且让SBD重新锚定美元。

假设steem价格增长飞快,比新增加的SBD速度还快,那么债务和所有权比例应该保持在一定程度,而且提供的利息可以维护所有人的利益。如果市场盘整或者下跌,提供的利息只能让债务所有权比例更糟糕。

如果债务和所有权比率变得危险的虚高,并且市场参与者不把SBD转换掉,那么旷工就应该调整策略,让转换SBD能获得更多的steem。改变利率政策或把steem/SBD转换率打折应该是一种缓慢的针对市场长期债务所有权比率偏离的方法,而不是针对短期价格波动的方法。

我们相信,这些方法给与市场参与者以信心,他们在1美元左右买入SBD是绝对不会亏损的!我们希望SBD在$0.95到$1.00这样一个很窄的范围内波动。

SBD被看作是一种债务,发行steem同时,就要产生对应价值的steem dollars,steem dollars可以领利息的。目前的情况就是“任何时候如果SBD价格比1美元大,就停止支付利息。在市场里,0%的利息还不能阻止人们对SBD需求的话,那就说明市场愿意接受更多的steem”,如此说明steem需求量很大,我猜想是越来越多平台使用了steemconnect,然后市场对SMTs的预期很高。最近仔细看了SMTs 的技术用户手册,我觉得要实现到传统网站平台的接入,还是有很多东西要考虑的。不过,连远远大于1美元的SBD,还有这么多人抢购,那说明投机者甚多啊!也说明对steem需求很旺盛!

更多区块链文章:

支付宝打赏

支付宝打赏